Fintechzoom Qqq Stock Prediction – Know In Detail!

As someone deeply invested in finance, I’ve learned that making informed predictions is both an art and a science. One keyword at the forefront of my investment journey is “Fintechzoom QQQ Stock Prediction.” It’s not just a phrase to me; it’s been a guiding light in navigating the tumultuous waters of the stock market.

Fintechzoom QQQ Stock Prediction is a tool for forecasting QQQ stock movements based on analysis and data trends.

Introduction To Fintechzoom Qqq Stock Prediction – Dive To Know More!

In today’s volatile stock market, having insights into the movements of popular exchange-traded funds like QQQ can be invaluable.

Fintechzoom QQQ Stock Prediction offers a glimpse into the future by employing advanced methodologies and cutting-edge algorithms.

By analyzing historical data, market trends, and many other factors, Fintechzoom provides investors with forecasts and predictions regarding the direction of QQQ stock.

With Fintechzoom’s predictive tools, investors can make more informed decisions, whether they’re considering buying, selling, or holding QQQ shares.

By delving into the intricacies of the stock market, Fintechzoom aims to empower investors with actionable insights, enabling them to navigate the complexities of the financial landscape with confidence.

As we delve deeper into the methodologies employed by Fintechzoom, we uncover a world of data-driven analysis and predictive modeling that aims to shed light on the future trajectory of QQQ.

Fintechzoom’s Methodologies And Algorithms In Predicting Qqq Stock Movements – Analyze Now!

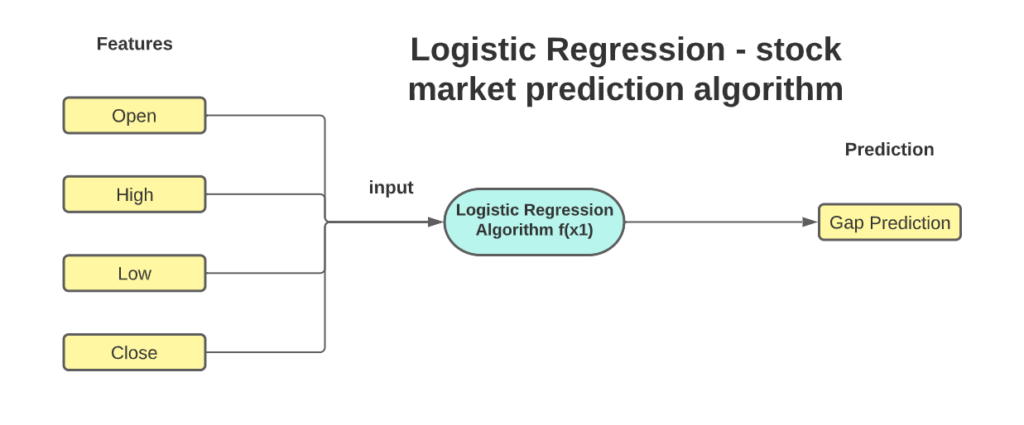

At the heart of Fintechzoom’s predictive prowess lies a sophisticated blend of methodologies and algorithms designed to decipher the intricacies of QQQ stock movements.

Through meticulous analysis of historical price data, market sentiment, and macroeconomic indicators, Fintechzoom’s algorithms strive to identify patterns and trends that could influence the future performance of QQQ.

Utilizing machine learning algorithms and statistical models, Fintechzoom continuously refines its predictive capabilities, incorporating new data and refining its methodologies to enhance accuracy.

By leveraging big data analytics and artificial intelligence, Fintechzoom aims to stay ahead of the curve, providing investors with timely and actionable insights into QQQ stock movements.

As investors analyze the methodologies and algorithms behind Fintechzoom’s predictions, they gain a deeper understanding of the factors driving QQQ’s performance. They can position themselves accordingly in the ever-changing market landscape.

Also Read: Nasdaq Fintechzoom – Everything You Need to Know!

Historical Performance Analysis Of Fintechzoom’s Qqq Stock Predictions – The Background Revealed!

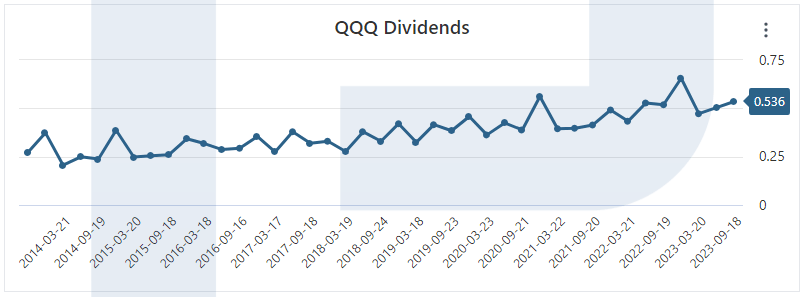

Understanding the historical performance of Fintechzoom’s QQQ stock predictions offers valuable insights into the reliability and effectiveness of its forecasting methodologies.

Over time, Fintechzoom has amassed a wealth of data, allowing for a comprehensive retrospective analysis of its predictive accuracy.

By scrutinizing past predictions against actual market outcomes, investors can gauge the consistency and reliability of Fintechzoom’s forecasts.

Through meticulous examination of historical data, patterns, and trends, one can discern the strengths and limitations of Fintechzoom’s predictive algorithms.

Moreover, delving into the historical performance of Fintechzoom’s QQQ stock predictions unveils critical factors that have influenced their accuracy.

Market volatility, macroeconomic conditions, and unforeseen events all shape the reliability of predictive models.

As investors delve into the background of Fintechzoom’s historical performance analysis, they gain a deeper understanding of the nuances and complexities inherent in forecasting stock movements.

By leveraging insights from past performance, investors can make more informed decisions, mitigating risks and maximizing opportunities in the dynamic world of stock trading.

Read Also: Luxury Fintechzoom – Elevate the Wealth!

Factors Influencing Qqq Stock Predictions By Fintechzoom – Explore Now!

Market Trends and Sentiment Analysis:

Fintechzoom analyzes prevailing market trends and sentiment to gauge investor behavior and market dynamics.

By monitoring factors such as trading volumes, price movements, and investor sentiment, Fintechzoom assesses the market’s collective mood and incorporates these insights into its predictive models.

Economic Indicators and Macroeconomic Trends:

Fintechzoom considers a broad array of economic indicators and macroeconomic trends that may impact the performance of QQQ stocks.

Factors such as GDP growth, inflation rates, unemployment figures, and interest rate changes are carefully scrutinized to discern their potential influence on QQQ’s trajectory.

Technological Advancements and Innovation:

The tech-heavy composition of the QQQ index necessitates a keen focus on technological advancements and innovation.

Fintechzoom tracks software, semiconductors, e-commerce, and cloud computing developments, recognizing their significance in shaping QQQ stock movements.

Regulatory and Legislative Changes:

Changes in regulations and legislation can significantly impact the performance of QQQ stocks, particularly within sectors subject to government oversight.

Fintechzoom stays abreast of regulatory developments, assessing their potential ramifications on QQQ constituents and adjusting its predictions accordingly.

Global Geopolitical Events:

Geopolitical events, such as trade tensions, geopolitical conflicts, and diplomatic relations, profoundly influence financial markets, including QQQ stocks.

Fintechzoom monitors geopolitical developments worldwide, recognizing their capacity to trigger market volatility and disrupt established trends.

Corporate Earnings and Performance:

Fintechzoom closely scrutinizes the earnings reports and performance metrics of companies comprising the QQQ index. By assessing revenue growth, profit margins, and guidance forecasts, Fintechzoom gauges the financial health and outlook of QQQ constituents, informing its predictive models accordingly.

Machine Learning And AI in Fintechzoom’s Qqq Stock Prediction – Learn In The Modern Era!

In the modern era of finance, Fintechzoom harnesses the power of machine learning and artificial intelligence (AI) to enhance its QQQ stock prediction capabilities.

By leveraging sophisticated algorithms and vast datasets, Fintechzoom’s machine-learning models analyze historical patterns and trends to forecast future movements in QQQ stocks.

Through iterative learning processes, these models adapt and refine their predictions in response to evolving market dynamics, providing investors with real-time actionable insights.

Moreover, AI-driven algorithms employed by Fintechzoom can uncover hidden correlations and relationships within complex financial data, offering a level of analysis beyond human capacity.

By identifying subtle patterns and anomalies, these algorithms enable Fintechzoom to anticipate market trends and capitalize on emerging opportunities.

As machine learning advances, Fintechzoom remains at the forefront of innovation, continuously refining its predictive models to deliver unparalleled accuracy and reliability in QQQ stock predictions.

Sentiment Analysis And Market Trends Impacting Qqq Stock Predictions – Know More Here!

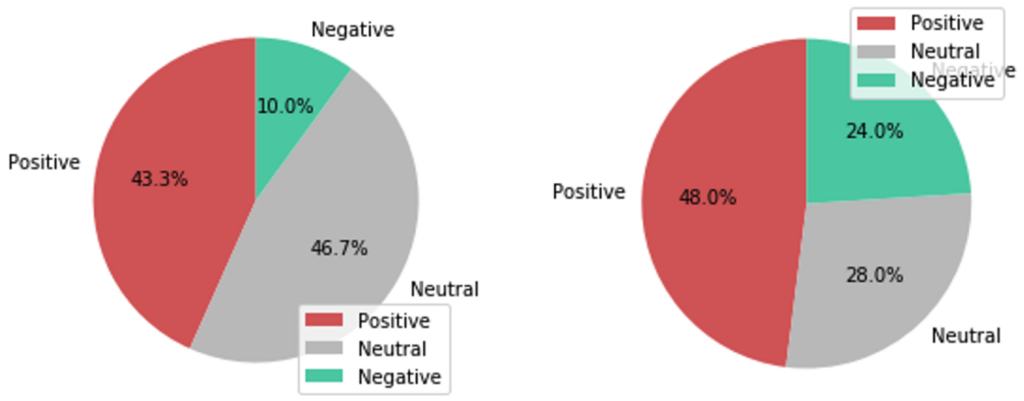

Sentiment analysis is pivotal in Fintechzoom’s QQQ stock predictions, offering valuable insights into investor sentiment and market trends.

By monitoring social media platforms, news articles, and financial forums, Fintechzoom gauges the collective mood of investors and identifies sentiment shifts that may influence QQQ stock movements.

Positive sentiment may fuel bullish market trends, while negative sentiment could trigger sell-offs and price declines.

Furthermore, Fintechzoom tracks many market trends impacting QQQ stock predictions, including sector rotations, industry developments, and global macroeconomic factors.

By staying abreast of evolving trends, Fintechzoom adapts its predictive models to reflect changing market conditions, ensuring investors receive timely and relevant insights into QQQ stock performance. As investors navigate the complexities of the stock market, understanding the impact of sentiment analysis and market trends is essential for making informed investment decisions aligned with their financial goals.

Risk Management Strategies – The Techniques Compiled!

Effective risk management strategies are crucial for safeguarding investment portfolios in the dynamic world of stock trading. Fintechzoom employs various techniques to mitigate risk and protect investors from potential losses associated with QQQ stock predictions.

Diversification, for instance, involves spreading investments across different asset classes and sectors to reduce exposure to any single risk factor.

By diversifying their portfolios, investors can offset losses in one area with gains in another, thereby minimizing overall risk.

Additionally, Fintechzoom advocates for using stop-loss orders, which automatically trigger the sale of QQQ stocks if they reach predetermined price levels. Stop-loss orders help investors limit losses and preserve capital in volatile market conditions.

Moreover, Fintechzoom emphasizes the importance of conducting thorough research and due diligence before making investment decisions. By thoroughly analyzing market trends, company fundamentals, and economic indicators, investors can make informed choices that align with their risk tolerance and investment objectives.

Limitations And Challenges In Fintechzoom’s Qqq Stock Predictions – Must Avoid!

While Fintechzoom’s QQQ stock predictions offer valuable insights into market trends and movements, it’s essential to acknowledge the limitations and challenges inherent in predictive modeling.

One notable limitation is the inability to predict unforeseen or black swan events that can disrupt market dynamics and render predictive models ineffective.

Additionally, historical data may only sometimes accurately reflect future market conditions, leading to discrepancies between predicted and actual outcomes.

Furthermore, Fintechzoom’s predictive algorithms may be susceptible to biases and errors inherent in the data used for analysis.

Data quality, sample size, and selection bias can impact the accuracy and reliability of predictions. Investors must exercise caution and avoid over-reliance on predictive models, supplementing them with qualitative analysis and expert judgment to mitigate the risk of making erroneous investment decisions.

Future Outlook For Fintechzoom’s Qqq Stock Predictions – The Upcoming Ideas!

Looking ahead, the future outlook for Fintechzoom’s QQQ stock predictions is marked by innovation and technological advancements.

Fintechzoom continues to refine its predictive algorithms, integrating cutting-edge machine learning techniques and AI-driven models to enhance accuracy and reliability.

Moreover, Fintechzoom explores novel data sources and alternative datasets to uncover unique insights into QQQ stock movements, providing investors a competitive edge.

Additionally, Fintechzoom remains committed to addressing investors’ evolving needs and preferences, incorporating feedback and suggestions to improve its predictive capabilities further.

By embracing innovation and emerging technologies, Fintechzoom positions itself as a leader in QQQ stock predictions, offering investors actionable insights and strategic guidance in navigating the complexities of the financial markets.

Frequently Asked Questions:

How does Fintechzoom predict QQQ stock movements?

Fintechzoom uses advanced algorithms and historical data analysis to forecast how QQQ stocks might behave.

Is Fintechzoom’s QQQ stock prediction consistently accurate?

While Fintechzoom aims for accuracy, stock prediction involves uncertainties, and outcomes may vary.

How can I use Fintechzoom’s QQQ stock predictions for investing?

Investors can use Fintechzoom’s predictions as one of many tools for making informed investment decisions.

Conclusion:

Fintechzoom QQQ Stock Prediction predicts changes in QQQ stock prices using analysis and data trends.

Also Read:

. Nasdaq Fintechzoom – Everything You Need to Know!

. Bitcoin Fintechzoom – Welcome To the World of Cryptocurrency!

. Crypto Fintechzoom – Complete Guidebook Of 2024!

. Netflix Stock Fintechzoom – A Comprehensive Guide On Investment!