Amd stock fintechzoom – Te Financial Insights!

From exhilarating market rallies to nerve-wracking dips, my experience with AMD on FintechZoom has been nothing short of a rollercoaster ride.

AMD stock on FintechZoom offers insights into its market performance, trends, and analysis, aiding informed investment decisions.

Introduction to AMD Stock – Know in Detail!

Are you intrigued to explore the journey of AMD stock? Advanced Micro Devices (AMD) is a leading semiconductor company renowned for its groundbreaking processors and graphics cards. Diving into the realm of AMD stock entails understanding its evolution, from its humble origins to its current stature as a pivotal force in the tech domain.

FintechZoom meticulously outlines AMD’s trajectory, highlighting its historical performance, key milestones, and strategic endeavours.

Whether you’re a seasoned investor well-versed in market dynamics or an enthusiastic newcomer navigating the realm of stock investments, comprehending AMD’s narrative proves instrumental in shaping informed investment decisions.

Embark on a journey through the annals of AMD’s stock evolution, traversing its triumphs and challenges alongside FintechZoom’s expert insights.

Discover the intricate interplay of market forces, technological innovations, and corporate strategies that have sculpted AMD’s trajectory and continue influencing its future endeavours.

Read: Isbn 9781649376176 – Decoding The Details!

Current Market Performance – Explore!

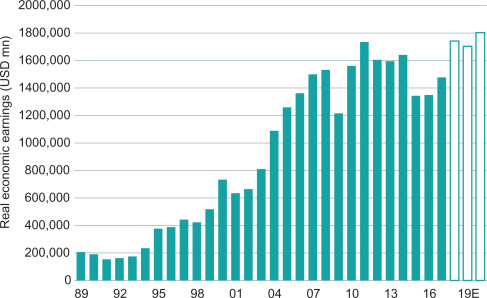

Delve into the dynamic landscape of AMD’s current market performance, where many factors converge to shape its trajectory. FintechZoom serves as your compass, providing real-time updates and astute analysis to illuminate AMD’s stock performance nuances.

Stay abreast of AMD’s stock price fluctuations, trading volumes, and market trends, vital metrics underpinning investment decisions.

Whether AMD experiences a surge in market sentiment or confronts challenges amid industry headwinds, FintechZoom equips investors with the insights needed to navigate the ever-shifting terrain of stock markets.

Explore the ebb and flow of AMD’s market performance, unravelling the intricate web of factors influencing its trajectory. With FintechZoom as your trusted guide, gain invaluable perspectives into AMD’s market dynamics, empowering you to make informed investment decisions amidst the whirlwind of market volatility.

FintechZoom’s Insights on AMD’s Financials – The Collaboration!

Collaborating with financial experts, FintechZoom delves deep into AMD’s economic landscape, offering comprehensive insights into its fiscal health and performance.

Through meticulous analysis of AMD’s financial statements, revenue streams, and expenditure patterns, FintechZoom unveils the underlying dynamics shaping the company’s economic trajectory.

By examining critical financial metrics such as revenue growth, profit margins, and cash flow, investors gain a holistic understanding of AMD’s financial prowess and resilience in the face of market challenges.

Furthermore, FintechZoom’s collaboration extends beyond mere numbers, delving into the strategic initiatives and corporate decisions driving AMD’s financial performance.

From R&D investments fueling technological innovation to strategic partnerships forging new avenues of growth, FintechZoom elucidates the strategic imperatives guiding AMD’s economic evolution.

Through this collaborative endeavour, investors gain actionable insights into AMD’s financial standing, empowering them to make informed investment decisions aligned with their financial objectives and risk tolerance.

AMD’s Market Position and Competitors – Elevate Now!

In the fiercely competitive landscape of semiconductor technology, AMD occupies a pivotal position, challenging industry incumbents with its innovative product offerings and strategic positioning.

FintechZoom thoroughly analyses AMD’s market position, dissecting its competitive advantages, market share dynamics, and strategic positioning vis-à-vis its peers.

By benchmarking AMD against its competitors, FintechZoom illuminates the company’s strengths, weaknesses, and areas of differentiation within the market ecosystem.

Moreover, FintechZoom scrutinizes the competitive landscape, shedding light on emerging trends, disruptive technologies, and threats shaping AMD’s market dynamics.

From Intel’s enduring dominance to NVIDIA’s prowess in the GPU market, FintechZoom provides a nuanced understanding of AMD’s competitive landscape, enabling investors to discern the strategic imperatives driving the company’s growth trajectory.

With these insights, investors can confidently navigate the competitive terrain, identifying investment opportunities that align with their risk appetite and investment objectives.

Recent Developments and News Impacting AMD Stock – The Brief Introduction!

Stay abreast of the latest developments and news shaping AMD’s stock performance with FintechZoom’s concise yet insightful coverage. FintechZoom briefly overviews the critical developments influencing AMD’s stock trajectory, from product launches and strategic partnerships to regulatory updates and market trends.

By distilling complex information into digestible insights, FintechZoom equips investors with the knowledge to interpret news events and their potential impact on AMD’s stock price.

Whether it’s a breakthrough in semiconductor technology or macroeconomic factors influencing consumer demand, FintechZoom briefly introduces the news impacting AMD stock, empowering investors to make informed decisions in a rapidly evolving market landscape.

Through timely updates and analysis, FintechZoom is your trusted ally in navigating the dynamic world of AMD stock investments.

Read: Forex Compounding Calculator – The Calculating Details Decoded!

FintechZoom’s Analysis of AMD’s Growth Prospects – Dive In!

Dive deeper into AMD’s growth prospects with FintechZoom’s comprehensive analysis, illuminating future expansion and market leadership pathways.

Leveraging industry expertise and data-driven insights, FintechZoom explores the drivers underpinning AMD’s growth trajectory, from expanding market opportunities to technological innovations driving product differentiation.

By examining AMD’s strategic initiatives, market positioning, and competitive landscape, FintechZoom unveils the factors shaping the company’s growth potential in the semiconductor industry.

Furthermore, FintechZoom delves into emerging trends and market dynamics, offering forward-looking perspectives on AMD’s growth prospects across key market segments and geographies.

Whether it’s the burgeoning demand for gaming consoles or the rise of cloud computing, FintechZoom’s analysis provides investors with a roadmap to navigate AMD’s journey towards sustained growth and market leadership.

With FintechZoom’s insights as your guide, investors can identify investment opportunities aligned with AMD’s growth trajectory, positioning themselves for long-term success in the ever-evolving semiconductor landscape.

Risks and Challenges Facing AMD – The Problems in the Way!

As AMD continues its journey in the competitive semiconductor industry, it faces many risks and challenges that could impact its performance and market standing. One of the primary challenges confronting AMD is intense competition from industry giants like Intel and NVIDIA.

These competitors possess significant resources, established market presence, and formidable technological capabilities, posing a threat to AMD’s market share and profitability.

Moreover, rapid technological advancements and changing consumer preferences add complexity to AMD’s competitive landscape, necessitating continuous innovation and agility to stay ahead of the curve.

Additionally, AMD is subject to macroeconomic factors and geopolitical tensions that can impact its operations and financial performance. Fluctuations in global economic conditions, trade policies, and currency exchange rates can affect AMD’s revenue streams, supply chain operations, and manufacturing costs.

Moreover, geopolitical tensions and regulatory changes may introduce uncertainties and constraints in key markets, further complicating AMD’s growth trajectory.

In navigating these risks and challenges, AMD must maintain strategic flexibility, resilience, and a keen focus on mitigating potential disruptions to its business operations and financial health.

By proactively addressing these challenges, AMD can enhance its competitive position and sustain long-term growth in the dynamic semiconductor landscape.

Understanding AMD’s risks and challenges is crucial for investors seeking to make informed decisions about their investment portfolios.

By acknowledging the potential headwinds and uncertainties, investors can assess AMD’s risk profile, evaluate its resilience, and make strategic investment decisions aligned with their financial objectives and risk tolerance.

Moreover, staying abreast of industry developments, regulatory changes, and market dynamics enables investors to anticipate potential risks and opportunities in the semiconductor sector.

With a comprehensive understanding of the risks and challenges facing AMD, investors can navigate the complexities of the market landscape and position themselves for long-term success in an ever-evolving industry environment.

Frequently Asked Questions:

What factors affect the price of AMD stock?

The price of AMD stock can be influenced by factors such as company earnings, product launches, competition in the semiconductor industry, overall market trends, and investor sentiment.

Is investing in AMD stock risky?

Like all investments, investing in AMD stock carries some level of risk. Factors such as market volatility, competition, and changes in technology trends can impact the performance of AMD stock.

Can I make money by investing in AMD stock?

Investing in AMD stock can generate profits if the stock price increases over time. However, it’s important to remember that stock prices can also decrease, leading to potential losses.

How often should I check my AMD stock investment?

It’s a good idea to stay informed about your investments, but checking your AMD stock investment too frequently can lead to unnecessary stress. Monitoring your investment periodically, such as quarterly or semi-annually, is sufficient.

Conclusion:

Investors can access valuable insights into AMD stock through FintechZoom, helping them understand market performance, trends, and analysis for making well-informed investment decisions.

Read Also: